The price of Bitcoin (BTC) rebounds at $ 105k after Moody’s collapse; Crypto ETF issuer sees 35% upside down

Cryptocurrencies once again gained foot on Monday after a rocky start to the trading session, reflecting a broader recovery at the risk of risk as entrepreneurs were digging the collapse of the US government bonds.

Bitcoin

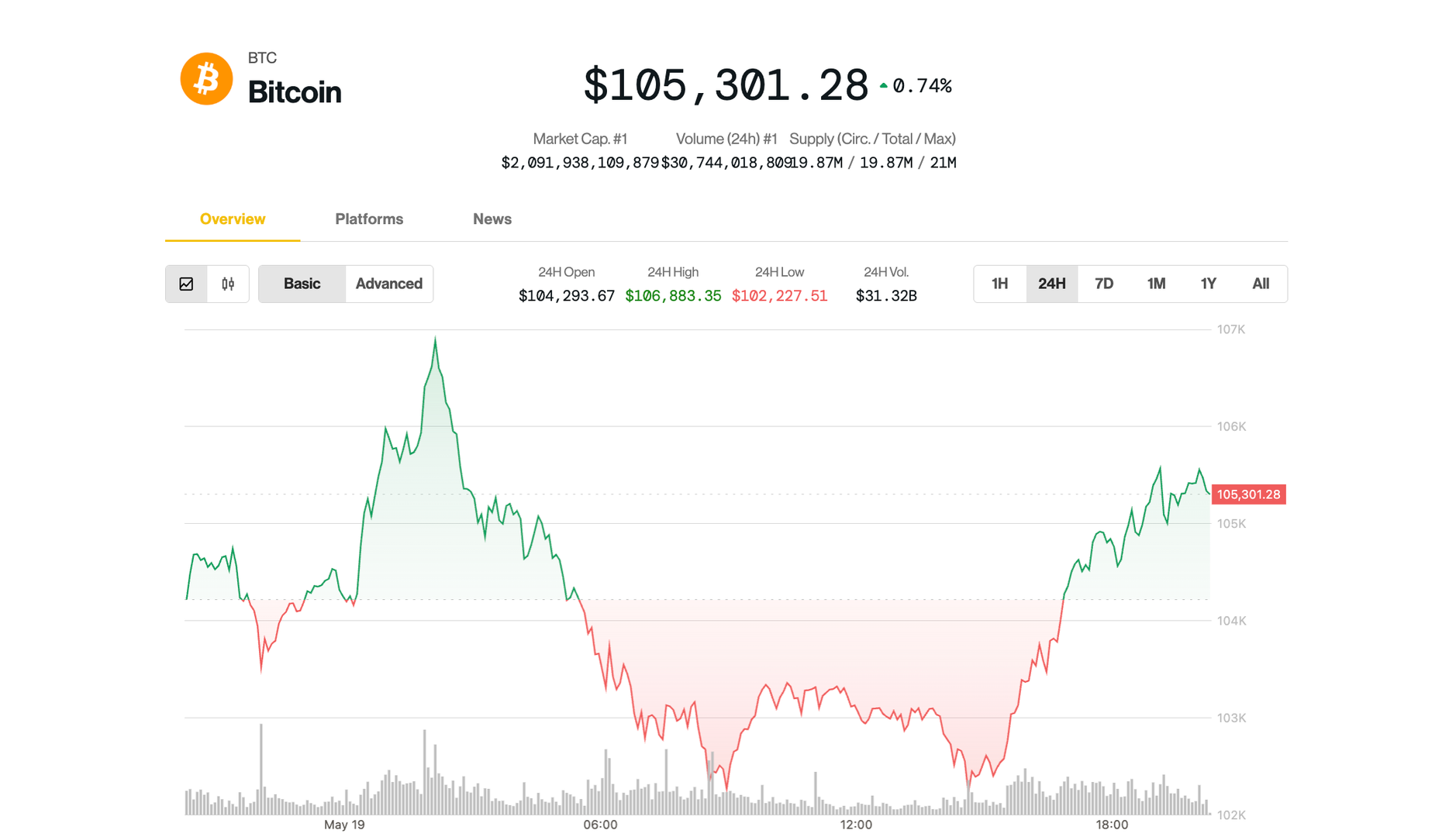

Noticed a strong rebound after slipping Up to less than $ 102,000 in advance of the US session, following a weekly record near $ 106,600 overnight. The largest cryptocurrency by the market cap rose back to $ 105,000 in Japanese trading, up to 0.4% in 24 hours. Ether rose 1.2%, recovering the $ 2,500 level.

Defi lending platform aave

Most large caps altcoins were released, while most broad-market CoinDesk 20 index members still remained in red despite advancing from their daily lows. Solana, avalanche and polkadot drop 2%-3%.

The bounce was expanded to US stocks, including the S&P 500 and Nasdaq that had removed their fall in the morning.

Early pulling in crypto and stock arrived after Moody’s late Friday lowered the US credit rating from AAA status. Moving Bond Bond markets, which drives the 30-year ark of human ark produces more than 5% and the 10-year note to more than 4.5%.

However, some analysts have lowered the long -term impact of falling on asset prices.

“What does it mean (falling) for markets? Longer-none,” said Ram Ahinllia, CEO of Wealth Management Firm Lumida Wealth. He added that in a short time there may be some pressure sellers centered on US wealth due to large institutional investors re-balance, as some of them are mandatory to handle property only on the security rated by AAA.

“Moody’s is the latest of the three main rating agencies to overthrow debt in the US. This is the opposite of a surprise – it’s a long time to come,” Callie Cox, chief market strategist at Ritholtz Wealth Management, said in an X post. “That’s why stock investors don’t seem to care.”

Bitcoin targets $ 138k this year

While BTC hovers just below January’s record prices, the Digital Asset ETF Issuer 21shares has seen more reversal for this year.

“Bitcoin is on the edge of a breakout,” strategic research writes Matt Mena in a Monday report. He argued that the current BTC rally was driven not by retail mania, but by a cluster of force structures, including institutional flows, a historical supply crunch and improving macro conditions suggesting a stronger and mature path to fresh time high.

Bitcoin ETF spots are constantly absorbed more BTC than Mined Days -Sun, tight supplies while major institutions, corporations such as strategy and newcomers a capital accumulated and even states explore the creation of strategic reserves.

These combined factors can lift the BTC to $ 138,500 this year, which is MENA -Forecast, which translates to a nearly 35% rally for the largest crypto.