Ripple Forms Downtrend Channel, next target of $ 2.75

The XRP collapsed on one of the worst trading days of 2025, which fell nearly 5% while institutions were loaded with the Rex-Ostf ETF debut.

Sell-the-News Dynamic removed $ 11 billion in market value and left the token fighting to defend the critical $ 2.77 support.

News background

• Inaugural US XRP ETF (Rex-osprey) Posted Record $ 37.7 million quantities of first-day volume, ETF’s largest launch of 2025.

• Whale wallets move $ 812 million to tokens between unknown session addresses.

• Crypto derivatives detect $ 1.7 billion in fluids, with 90% coming from a long position.

• Fed Policy Pivot Looms: September inflation cooled at 2.18%, with markets pricing a 50 bps cut before the end of the year.

• Bitcoin’s dominance rises to 57.7% as the capital revolves around the altcoins.

Summary of price action

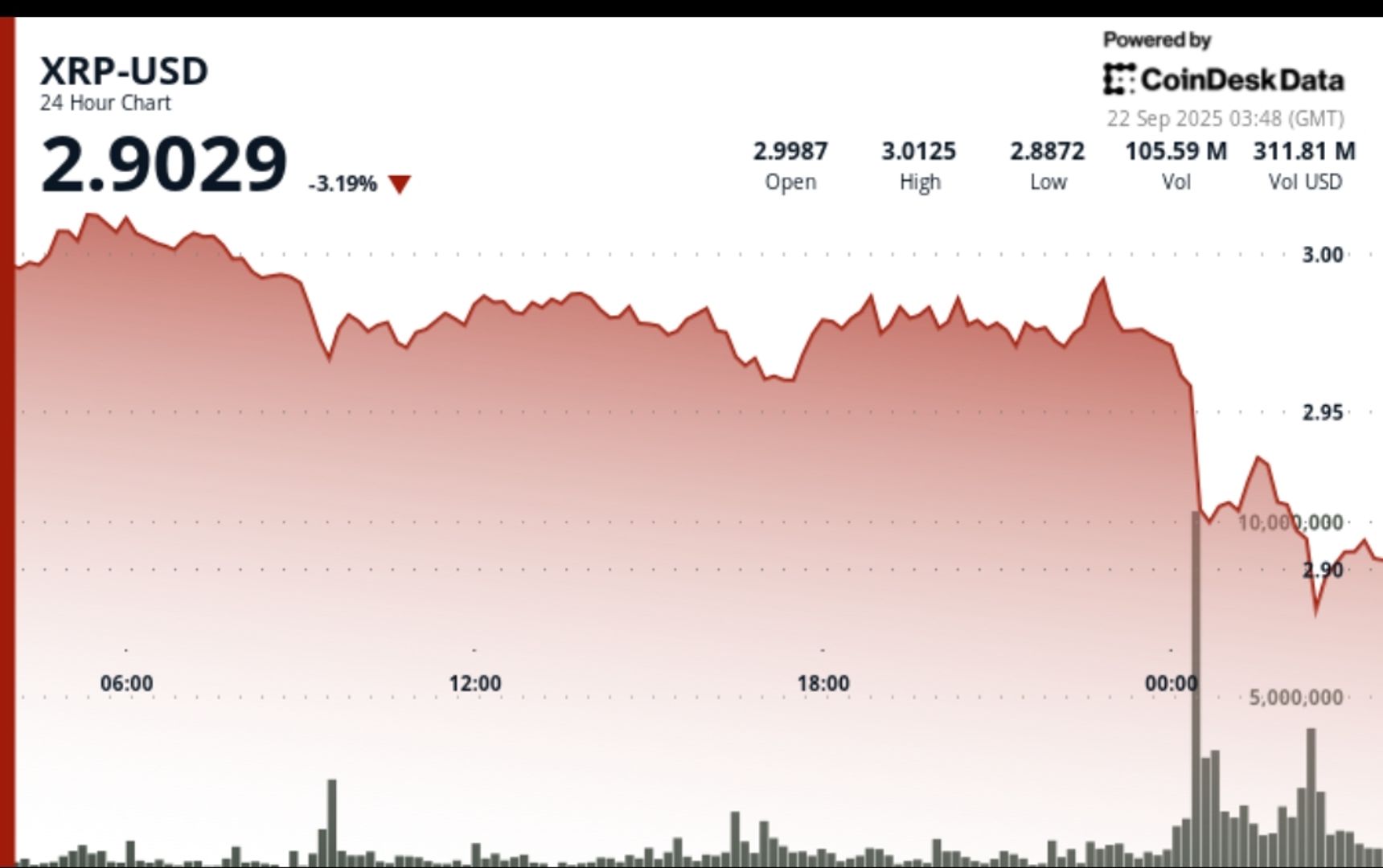

• XRP crashes from $ 2.87 to $ 2.77 to a 24-hour length (Sep 22 03: 00 – Sep 23 02:00 GMT)a 4.9% collapse at a range of $ 0.14.

• Flash crashing at 06:00 gmt detected (6x day -day avg of 105m).

• The resistance hardened to $ 2.87 with repeated intraday refusal.

• Recovery leaks at $ 2.86 by 13:00 gmt before stopping.

• Integration -Japanese will be held by $ 2.83– $ 2.87 before the seller can control.

• The last time of rejection lasted prices from $ 2.85 to $ 2.83 (-0.7%)Leaving XRP at $ 2.83 nearby.

Technical analysis

• Support: $ 2.77 critical floors from flash crash; Second level of $ 2.82 -Flag for Retest.

• Resistance: Strong supply zone at $ 2.87, with lower highs forming the downtrend channel.

• Volume: 656.1m in crashing compared to 105m avg confirms institutional disposal.

• Trend: The lower ones at $ 2.856 and lower lows to $ 2.83 established a short -term bearish channel.

• Indicators: Momentum skewed bearish, with a breakdown risk towards $ 2.75- $ 2.70 if $ 2.82 fails.

What do entrepreneurs watch

• Can the second trial support $ 2.77 after a flash crash?

• ETF flow: Day-two demand will stabilize the price or confirm a sell-the-News event?

• The Wallet Wallet Establishment after $ 812M has moved to the session.

• Fed rate cutting rate and its effect on dollar liquidity.

• BTC’s dominance at 57.7% – the pressure of rotation in the altcoins is likely to continue.