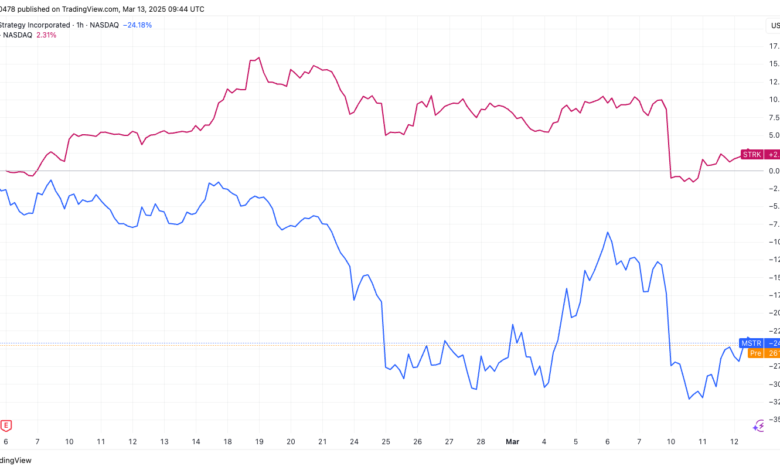

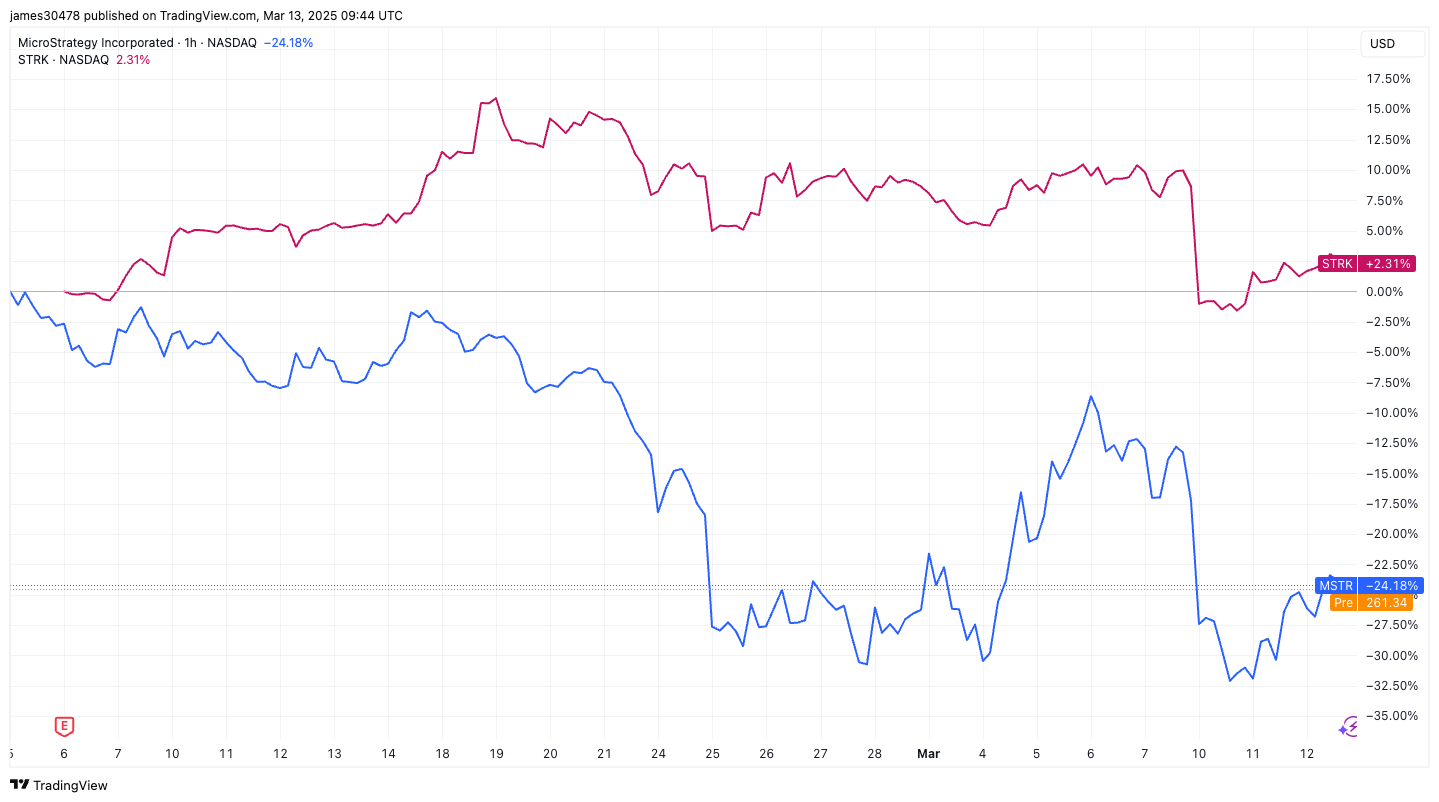

The strategy series a preferred stock is that -buck the recent collapse of MSTR

Denial: The analyst to write this piece owns the strategy sharing (MSTR).

Strike (Strk), the preferred stock issued by the Bitcoin Buyer Strategy (MSTR) is listed in just one month and is currently 3% higher than the introduction of February 5. The standard stock approach, on the other hand, is 20% less than the same period.

The preferred stock like Strk can be considered as a hybrid of equity and debt. Holders have greater right to share payments than those who usually have -owned stock if the company makes them and also the owners of the company in the event of a destruction. Strk is an eternal issue, lacking a maturity date (such as equity) and paying a fixed dividend (such as a debt).

Those features mean preferred stock tend to be less than a usual than the usual stock. That certainly seems the case for Strk. According to Strategy dashboardSTRK has a 26% correlation with MSTR and a slightly negative -7% touch with Bitcoin (Btc). It also does not change the mind, by 49%, compared to nearly 60%of Bitcoin and MSTR’s volatility of over 100%.

Last week, strategy announced a $ 21 billion at-the-market (ATM) offers for strk. That is, it is ready to sell up to that stock amount at the current market price for a period of time. If all STRK is sold, the company will face a total annual dividend bill of nearly $ 1.68 billion.

Developing cash amount means that the company can sell standard stock through an ATM offer – not likely to be given a depressed price of sharing such as the latter – use cash generated from operations or proceeds from any replaced debt.

The STRK has offered an 8% annual dividend yield based on $ 100 destruction preference and at the current price of $ 87.45, offers an effective yield of almost 9%. Like the debt, the higher the price of the STRK, the lower the yield, and the vice versa.

The STRK also includes a feature that allows each part to be converted to 0.1 parts of the standard stock, equal to a 10-to-1 ratio, when the MSTR price reaches or exceeds $ 1,000. The stock stock was closed to $ 262.55 on Wednesday, for the option of being able to live a great deal, offering potential reversal beyond the fixed Dividend of the STRK.

As a product that generates a lower volatility, the STRK presents a more stable choice with potential reversal. However, the massive ATM offer can affect this potential reversal, similar to how ATM sales have affected the performance of the standard stock.