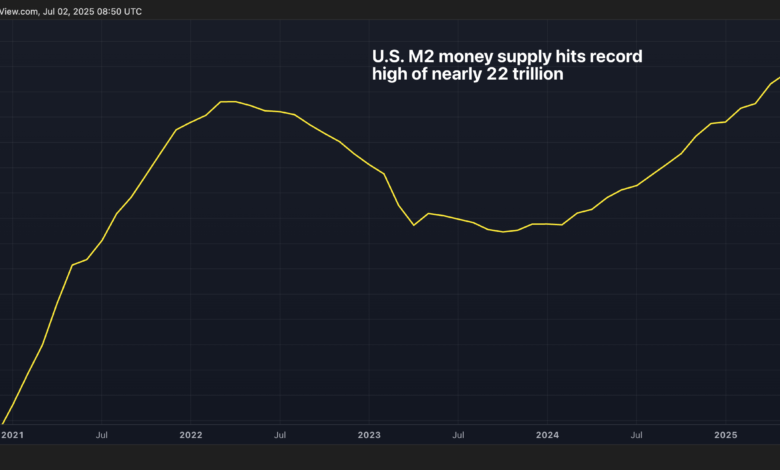

The US M2 currency supply hit at a high $ 22t. Is it bullish for BTC or inflation?

A comprehensive measure of currency circulation in the US has risen to new highs, a signal of economic growth that posts adverse messages for the Bitcoin path

.

The M2 supply of moneywhich includes the hard currency and bank and money market mutual fund deposit that is relatively liquid, rose to a record of $ 21.94 trillion by the end of May, which led the previous peak of $ 21.72 trillion in March 2022, according to Barchart.com’s data resources. Year-on-year growth rate matching 4.5%of April, which is also the highest in nearly three years, according to Source of data yahoo finance.

For cryptocurrencies, the message is mud. Usually, a growing supply of money is taken as a signal of more spacious financial conditions and a growing economy that promotes more investor exposure to risk assets.

On the other hand, the growth of money supply can lead to inflation if it exceeds the economy, according to Cyprus -based Tiomarkets. Inflation concerns can reduce investment risk and force the federal reserve to raise interest rates.

In recent years, a rising M2 has a significant impact on Fed’s preferred inflation, personal consumption expenditure (PCE) Inflation. The PCE began to rise in February 2021, one year after the M2 growth began to rise in February 2020 and followed the growth of the M2 lower in 2023, St. Louis Federal Reserve in a Blog post.

If history is a guide, the ongoing eruption Recently called For President Donald Trump.