US Bitcoin Etfs Post Year Biggens 2nd Explws, may be more on the way

The boxes circulating on the stock exchange in the United States (BTC) witnessed the second largest external flow from the year on Monday, when it fell 516.4 million dollars, Farside data He appears.

The clouds, the ninth net flow in 10 days, reflect an increasing discomfort with the largest encrypted currency, which was traded in a narrow price range ranging between 94,000 dollars and 100,000 dollars for most of this month.

On Tuesday, Bitcoin broke out from its three -month channel, as it decreased to less than $ 90,000 and Slip to 88,250 dollars.

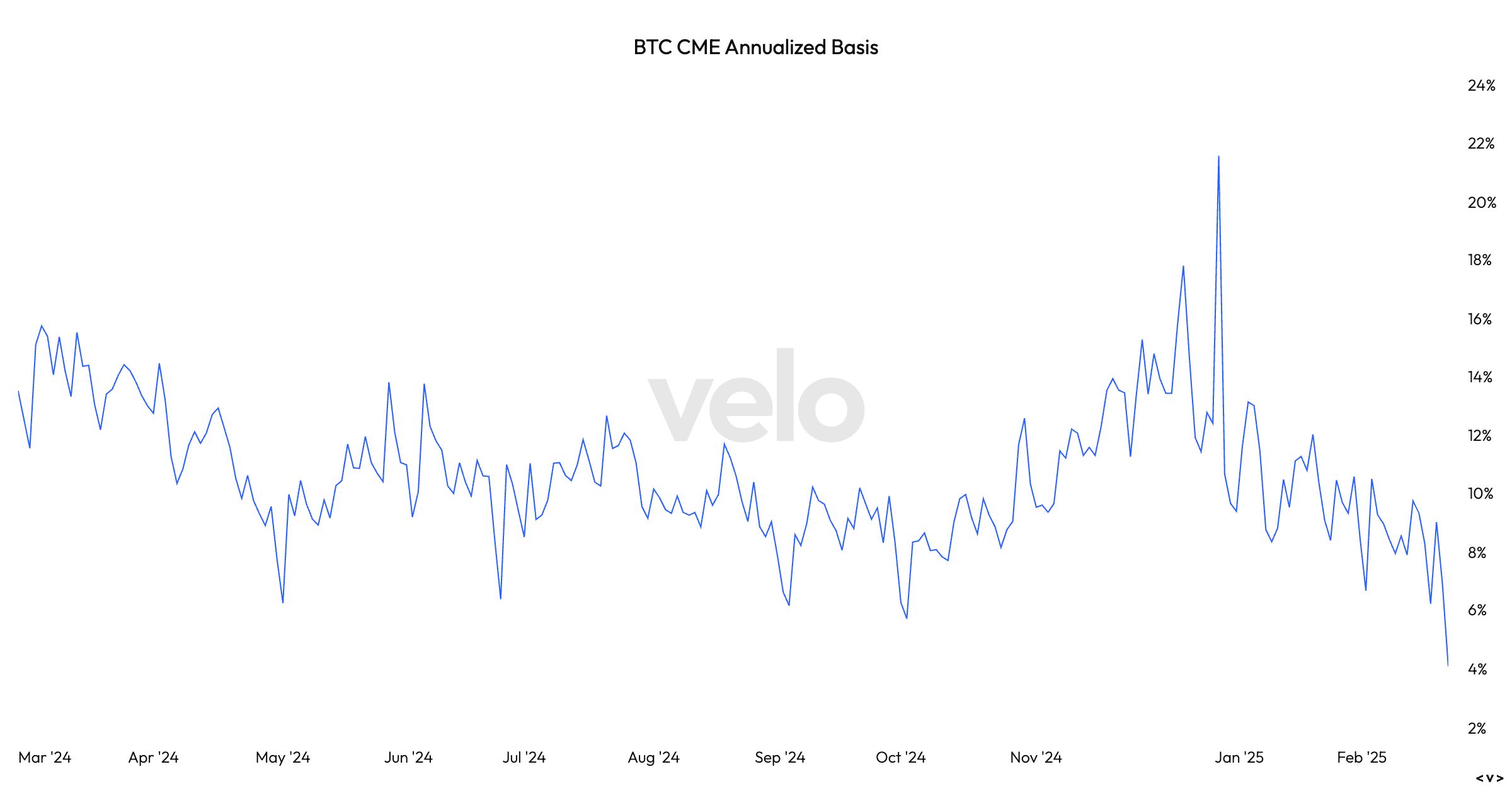

According to VELO data, the annual Bitcoin CME is decreased – the difference between instant price and futures contracts – to 4 %. This is the lowest level since the investment funds circulated in January 2024. This is also known as the money and heat trade, a neutral strategy in the market that seeks to benefit from the bad between the two markets.

The strategy includes taking a long location in the immediate market and a short position in the futures market. Velo data shows a future contract for one month. Investors collect a allowance between the spread of the place and the future prices until the date of the end of the futures contracts is closed.

On the current level, the foundation trade is less than the average of the so -called risk -free, which is the 10 -year -old treasury in the United States. The teams may convince investors to close their sites in favor of the largest return. You can see more external flows of traded investment funds. Since this is a neutral strategy, investors will also have to close their short position in the futures market.

Arthur HayesThe co -founder of Bitmex, hints to the commercial foundation that reveals in a post on X.

He wrote: “Many IBIT holders are the hedge funds that have long been the future of Etf Short CME to gain a greater return than where you are financed, in the short term of the United States Treasury.” “If this basis decreases with Bitcoin’s decrease, he will sell this IBIT money and CME futures decline. Mogho!”

publish_date