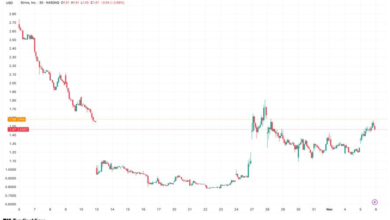

Ripple is worth $40B in funding round

Ripple has raised $500 million in a new strategic investment led by Fortress Investment Group and Citadel Securities, valuing the crypto firm at $40 billion. Other participants included Pantera Capital, Galaxy Digital, Brevan Howard and Marshall Wace.

“This investment reflects both Ripple’s incredible momentum, and further validation of the market opportunity we are aggressively pursuing with some of the world’s most trusted financial institutions,” said Brad Garlinghouse, Ripple CEO. “We started in 2012 with one use case – payments – and expanded the success to custody, stablecoins, prime brokerage and corporate treasury, using digital assets like XRP. Today, Ripple stands as a partner for institutions looking to access crypto and blockchain.”

The deal comes on the heels of Ripple’s recent $1 billion tender at the same valuation. This latest fund is structured as new common equity and expands Ripple’s investor base to include some of the biggest names in finance,” the company said.

Known for the XRP token’s usurpation of the payment infrastructure, Ripple has expanded beyond cross-border remittances. In the past two years, it has acquired six companies—including two billion-dollar-plus deals—among them, custody provider MetacoStableCoin Platform Rail, and Treasury firm Gtreasury.

Those acquisitions are starting to turn Ripple’s business around. Ripple payments, its flagship product, now handles more than $95 billion in volume. RLUSD, Ripple recently launched StableCoin, surpassed $1 billion in market cap This week and is already being used as collateral on Ripple Prime, the firm’s institutional broker platform.