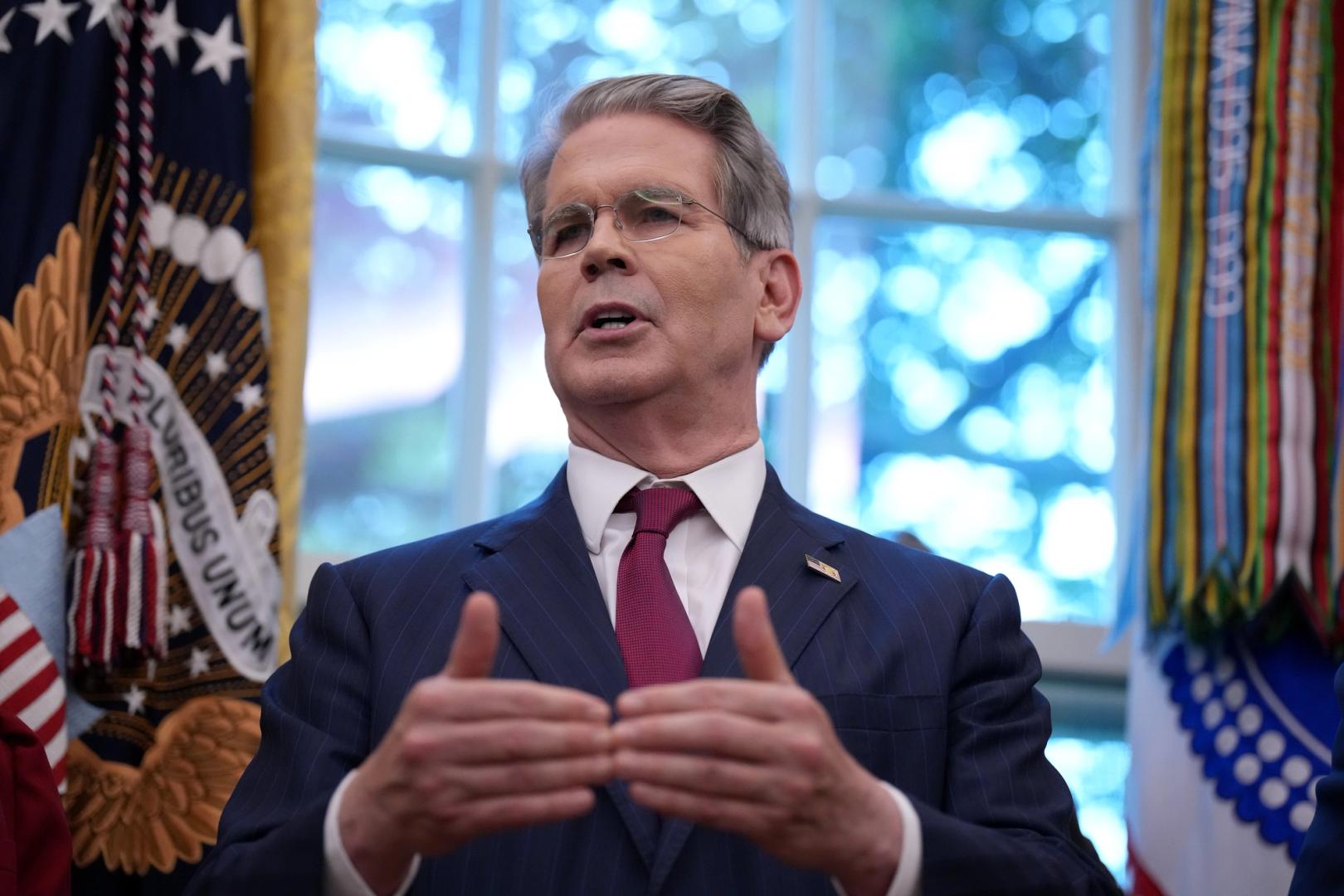

US Treasury Secretary Scott Bessent praises Bitcoin’s stability

US Treasury Secretary Scott Bessent marked the 17th anniversary of Bitcoin White Paper on Friday with a Post In x praised the stability of the network and added a jab at Senate Democrats, saying the system is “never brought down” and suggesting lawmakers could “learn something from that.” The comment doubles as a policy signal and a partisan nudge.

October 31 carries special weight in crypto. It’s the date Satoshi Nakamoto released the nine-page Bitcoin white paper in 2008, the document that sketched a peer-to-peer electronic cash system and set the stage for a network that has run continuously since January 2009. Supporters use the anniversary to highlight bitcoin’s timeless design and its independence from any single operator.

Bessent’s note spaces a year of crypto-forward messaging from the Treasury.

In July, following President Trump’s signature on the Genius Act, Bessent called StableCoins “A Revolution in Digital Finance” and argued that an internet-native dollar train could boost reserve-current status while expanding access to dollar payments. The Treasury published that statement on its website.

In August, Bessent said In X that Bitcoin is abolished in the US will provide a strategic reserve of bitcoin and the treasury will explore non-budgetary ways to add more, signaling interest in building holdings without new allocations.

Reaction to Friday’s post exposed a familiar rift within crypto.

Longtime Bitcoin core developer Luke Dashjr has pushed back, saying Bitcoin is “more vulnerable than ever,” a nod to misunderstandings over recent software releases and what that means for the network’s purity.

Researcher Eric Wall responded sarcastically that “Bitcoin died after the V30 major release,” poking at the repeated fate it takes after upgrades.

Investor Simon Dixon reframed Bessent’s line as a critique of monetary policy, arguing that Bitcoin’s point is protection from political fallout.

Others pressed for policy action: Entrepreneur Fred Krueger stopped short that the Treasury should buy bitcoin for strategic reserves, and digital asset strategist Gabor Gurbacs urged putting Bitcoin “on the balance sheet.”

Responses have split into two camps – technical purists contesting blanket claims of resilience, and market participants pressuring the Treasury to be rhetorical on procurement policy.

The political edge is sharpened by time. The federal government has been in a partial shutdown since Oct. 1 after Congress missed the fiscal 2026 appropriation, resulting in roughly 900,000 furloughs, nearly 2 million employees working without pay, and halting operations at agencies including the NIH and CDC. The episode was the 11th shutdown at Curtail Services and was described as the longest full shutdown on record.

Read narrowly, Bessent’s post hailed a network that operates on weekends and holidays. Read the political, it compares Bitcoin’s time to a Congress that is stuck on funding bills – another sign that the head of the Treasury intends to keep digital assets in the policy conversation on Washington’s busiest days.