USDT has fallen by a large percentage since the FTX crash on MiCA, raising fears of a broader cryptocurrency decline

USDT from Tether, the world leader A stable coin linked to the dollarwitnessed the largest weekly decline in market value in two years, raising concerns about market volatility.

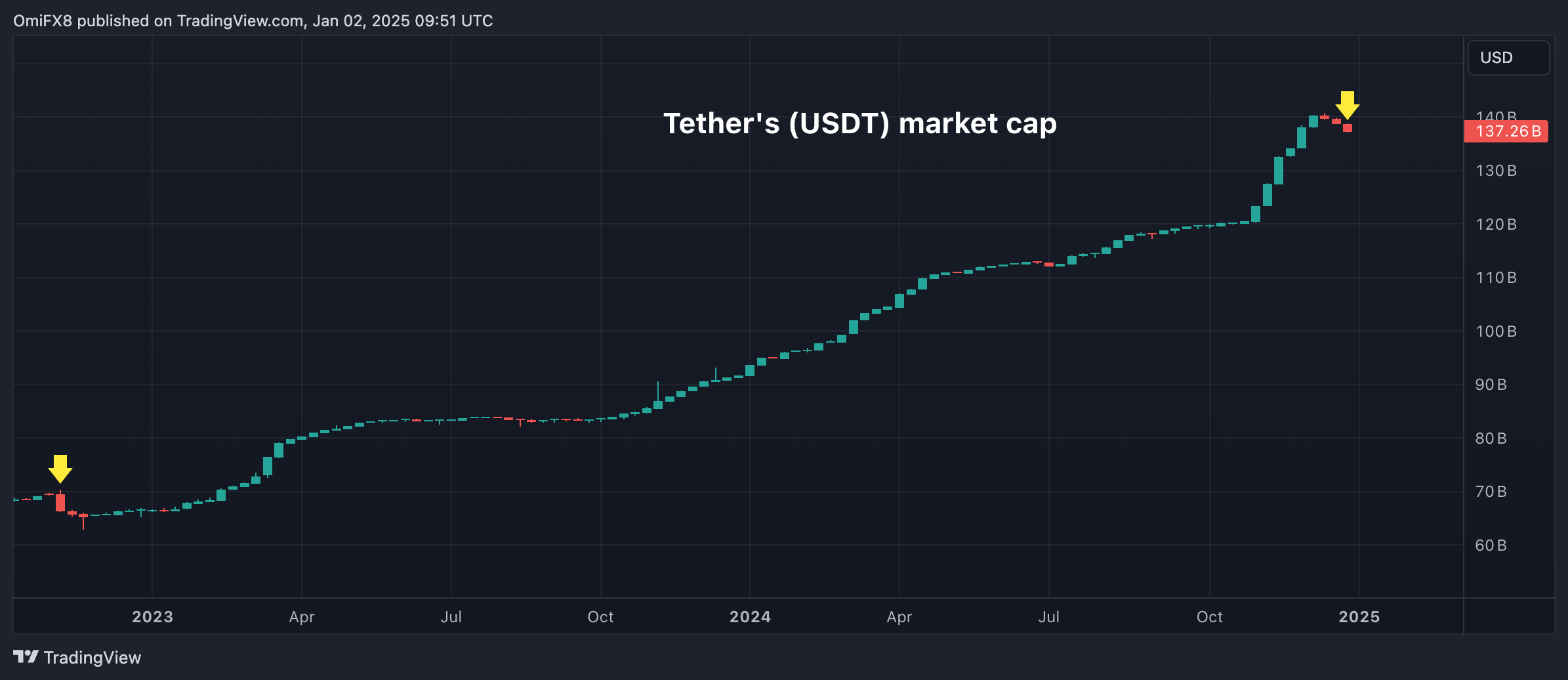

USDT’s market capitalization fell more than 1% to $137.24 billion this week, the largest decline since the FTX exchange collapsed in the second week of November 2022, TradingView data showed. It reached a record high of $140.72 billion in mid-December.

This decrease comes after a decision by several EU-based exchanges and Coinbase (COIN) for removal USDT due to compliance issues with EU Crypto Asset Markets (MiCA) regulations taken Full effect on December 30Although rules regarding stablecoins – cryptocurrencies whose value is tied to real assets such as the dollar – have begun to be implemented Six months ago.

The regulation requires issuers to obtain a MiCA license to publicly offer or trade asset tokens (ARTs) or electronic money tokens (EMTs) within the block. An ART is a crypto-asset that seeks to maintain a stable value by referencing another asset such as gold, tokens, or a combination of both, including one or more fiat currencies. ERTs refer to a single national currency, just as USDT does.

EU-based traders can still hold USDT in non-custodial wallets, but cannot trade it on MiCA-compliant central exchanges.

USDT serves as a gateway to the cryptocurrency market, widely used by investors to fund spot cryptocurrency purchases and derivatives trading. As such, it has been delisted and its market value has decreased Raised speculation From the broader crypto market segment on social media.

However, these fears may be unfounded, and their impact may be negative at best Limited to the EurozoneKaren Tang, head of APAC partnerships at Orderly Network, a permissionless Web3 liquidity layer, said in a post on X.

“Access to @Tether_to be restricted in the EU due to MiCa regulation will not harm USDT’s dominance,” Tang wrote. “The EU is not the largest cryptocurrency market. Most of the cryptocurrency trading volume happens in Asia and the US. All of this will hamper digital asset innovation in the EU, which is already slow due to over-regulation. If I could sell the EU, I would.” .. ”

Asia accounts for the largest share of Tether’s volume, downplaying the impact of MiCA-led delistings in Europe, said cryptocurrency analyst BitPlayz.

“USDT is the largest stablecoin, with a market capitalization of US$138.5 billion and a daily trading volume of US$44 billion. As of today, 80% of USDT trading volume comes from Asia, so removing the EU from the list will not have any severe impact. ” Bitblaze is referenced on X.

Tether has invested in MiCA-compliant companies Stabler and Quantose Payments In an effort to ensure regulatory compliance.

publish_date