Blog

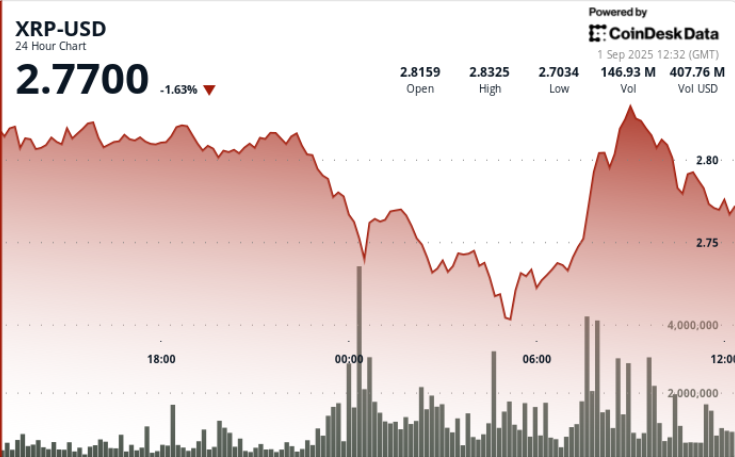

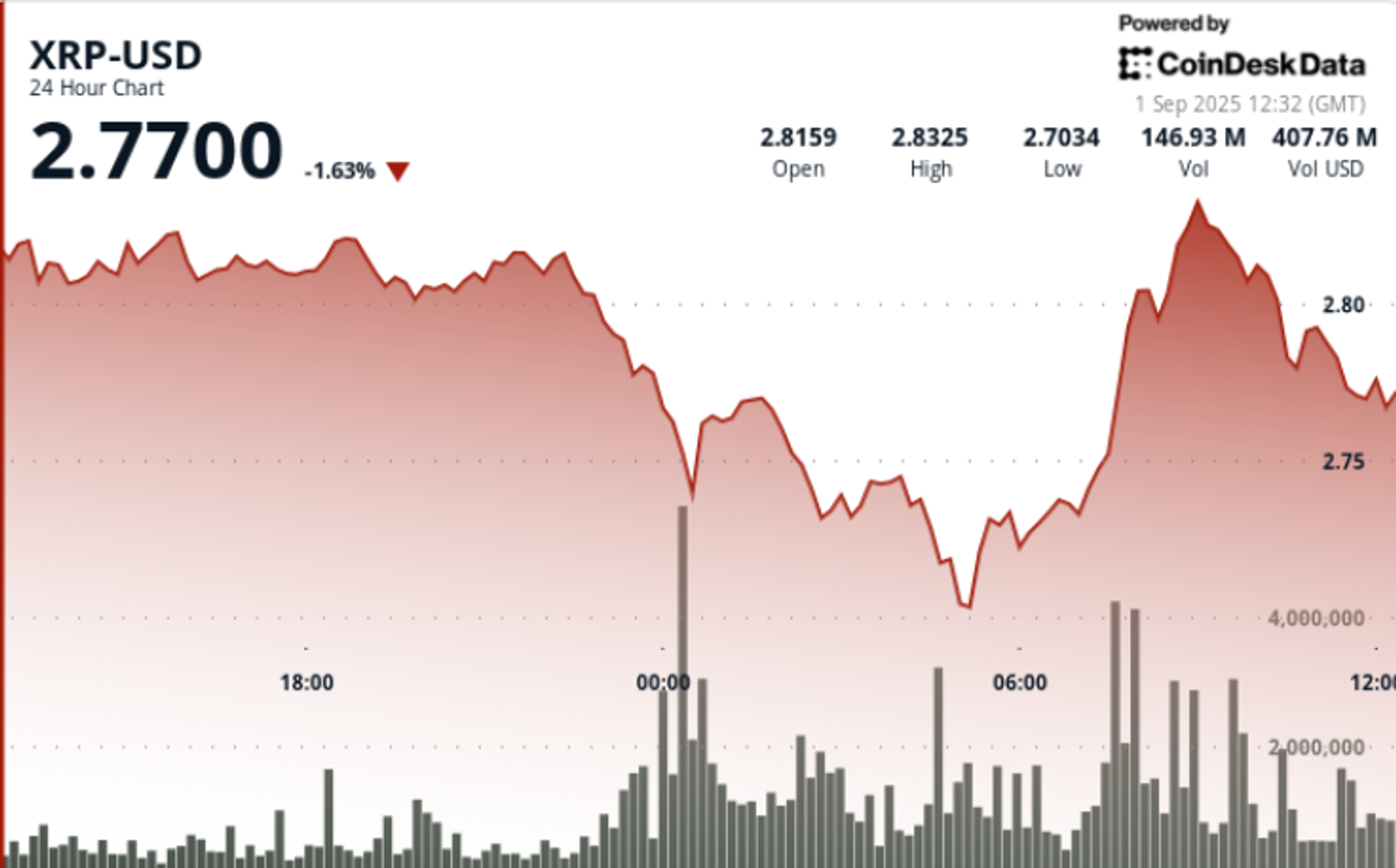

Volatility of volatility while price holds $ 2.77 support

The tokens were trading between $ 2.70- $ 2.84 on August 31 -Sept. 1 window, with whale accumulation that lowers heavy resistance to $ 2.82- $ 2.84.

News background

- XRP fell from $ 2.80 to $ 2.70 in late August 31 -The early September 1 before rebounding to $ 2.82 in heavy quantities.

- Whales have accumulated 340m XRP in two weeksa signal of institutional beliefs despite the short -term bearish pressure.

- The on-chain activity spiked to 164m tokens were exchanged on September 1 ammore than double average sessions.

- September remains a historic weak moon for crypto, but whale accumulation is viewed as a counterbalance in the retail flow.

Summary of price action

- Trade coverage has spanked $ 0.14 (≈4.9%) between $ 2.70 low and $ 2.84 high.

- The steep decline arrive 76.87m volumeAlmost 3x days -average.

- At 07:00 gmt Sept. 1, Bullish flows pushed a rebound from $ 2.73 to $ 2.82 to 164m volumecement of $ 2.70- $ 2.73 as near-term support.

- Final Integrating -Is with time (10: 20–11: 19 GMT) Discovered a slip price of 0.71% from $ 2.81 to $ 2.79, with heavy sale between 10: 31–10: 39 to 3.3m volume per minuteConfirmation resistance to $ 2.80- $ 2.81.

Technical analysis

- Support: $ 2.70- $ 2.73 floors repeatedly defended, strengthened by the whale purchase.

- Resistance: $ 2.80- $ 2.84 remains a decline zone, with $ 2.87- $ 3.02 as the next reversed threshold.

- Momentum: RSI near the mid-40s after rebound, showing neutral-to-bearish bias.

- MACD: The compression phase continues; Potential crossover if accumulation continues.

- Patterns: Symmetrical triangle forming with compression compression; The breakout path remains open to $ 3.30 if the resistance is eliminated.

What do entrepreneurs watch

- If holding $ 2.70- $ 2.73, short-term entrepreneurs will treat it as a springboard for $ 2.84 retests.

- A close above $ 2.84 will put $ 3.00- $ 3.30 back in play.

- Downside Scenario: Breach of $ 2.70 exposes $ 2.50 as the next structural support.

- The accumulation of whale compared to the sale of the institutional-the push-pull dynamic that can dictate the direction of September.