Whale wakes up after 12 years, shifting 1,000 BTC leading to FOMC’s decision

A prolonged dormant whale of Bitcoin moved nearly $ 116 million worth of cryptocurrency after 12 years, before the US Federal Reserve Interest Rate decision was watched.

The unknown Whale Woke up after 12 years of dormancy to move 1,000 Bitcoin (Btc) – costs nearly $ 116 million in current prices – which he first earned for nearly $ 847 per coin. The BTC costs about $ 847,000 at that time, which the whale has for more than a decade before transferring it to new purses on Wednesday, according to the Blockchain data platform Lookonchain.

More than $ 100 million moves took place shortly before the upcoming federal federal market committee (FOMC) meeting Wednesday, an expected event that could deliver the first reduction in the US interest rate of the year.

Related: Standard Chartered Venture Arm to raise $ 250m for Digital Asset Fund: Report

Crypto entrepreneurs pay for volatility market leading to FOMC meeting

Observers call the Fed’s decision to be one of the most important of the year, with 96% of participants expecting a 25 cut basis, According to In the Fedwatch tool of the CME Group. That estimate was from 85% a month ago.

“Tomorrow is the most important FOMC of our lives … Until next time,” said the founder and CEO of Into The Cryptoveher, Benjamin Cowen, on a Wednesday X Post.

Related: NASDAQ has announced that Helius is listed a $ 500M fund for Solana Treasury

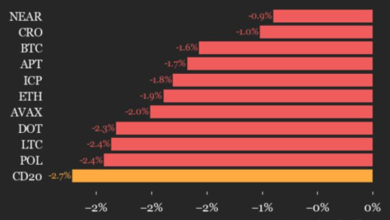

Despite the optimistic perspective, most cryptocurrency entrepreneurs position themselves for a short -term decline in the crypto market.

More than 57% of Bitcoin holders in all exchanges are Currently short, Mean that they have estimated to decline in bitcoin prices, while only 42% remains long, according to blockchain data from Coinank.

Meanwhile, meanwhile Open the bitcoin futures The interest fell over $ 2 billion in five days, signing more de-risking among futures businessmen leading the FOMC meeting, Cointelegraph reported Monday.

However, entrepreneurs in the world’s largest exchange, Binance, are buying Bitcoin leading the main interest rate decision.

Binance saw nine days of “constructive” for Bitcoin leading to the FOMC meeting, a trend that seemed to be a “main driver behind the recent Bitcoin bounce from $ 108K to +$ 115K,” According to In the onchain insights platform cryptoquant.

Bank Analysts America expects at least two reductions in Fed interest rates in 2025 – September and November – while economists in Goldman Sachs have set up three 25 bps cut for this year, Cointelegraph reported on September 6.

https://www.youtube.com/watch?v=6G35Ewcewum

Magazine: Bitcoin’s dominance will fall in 2025: Benjamin Cowen, X Hall of Flame