Blog

Chainlink (Link) acquires 4.5 % with an increase in index rates

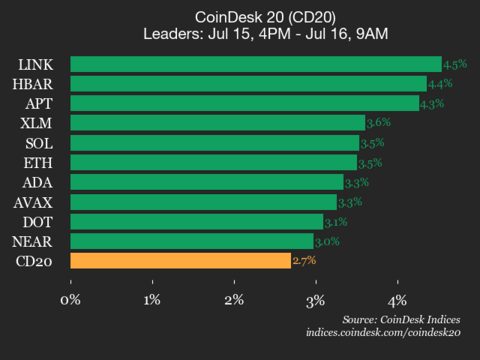

Coindsk indicators The update of the daily market displays, highlighting the performance of leaders and arrears in Coindsk 20 Index.

Coindesk 20 is currently trading at 3701.0, an increase of 2.7 % (+97.31) Since 4 pm Easter on Tuesday.

Nineteen of 20 assets are higher.

Leaders: Link (+4.5 %) And hbar (+4.4 %).

Laggars: ICP (-0.4 %) Normal (+0.6 %).

the Coindesk 20 It is a wide trading index on multiple platforms in several regions worldwide.

publish_date