Why do traders shorten Bitcoin after the BTC price has reached a new record?

Bitcoin {BTC} joined a new record exceeding $ 110,000 on Thursday, which led to the liquidation of about $ 500 million of derivatives in the wake of it, but some merchants do not buy in the upcoming feelings.

The trading volume jumped by 74 % over the past 24 hours, as merchants have tried to put themselves, however, the majority of these merchants choose to stand – or bet on Bitcoin moving down.

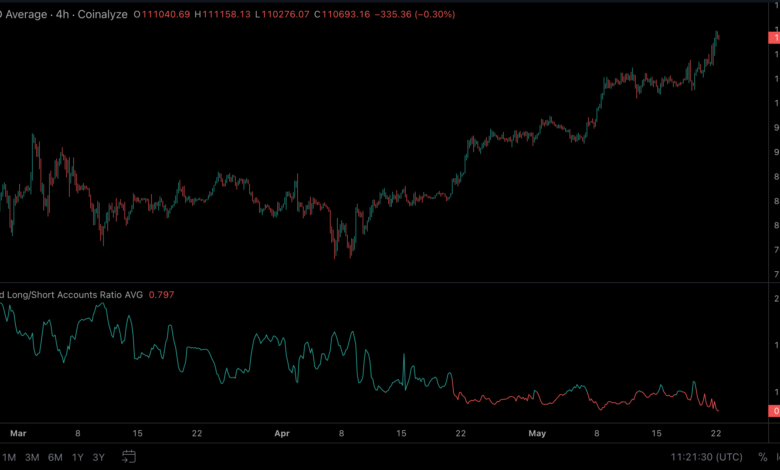

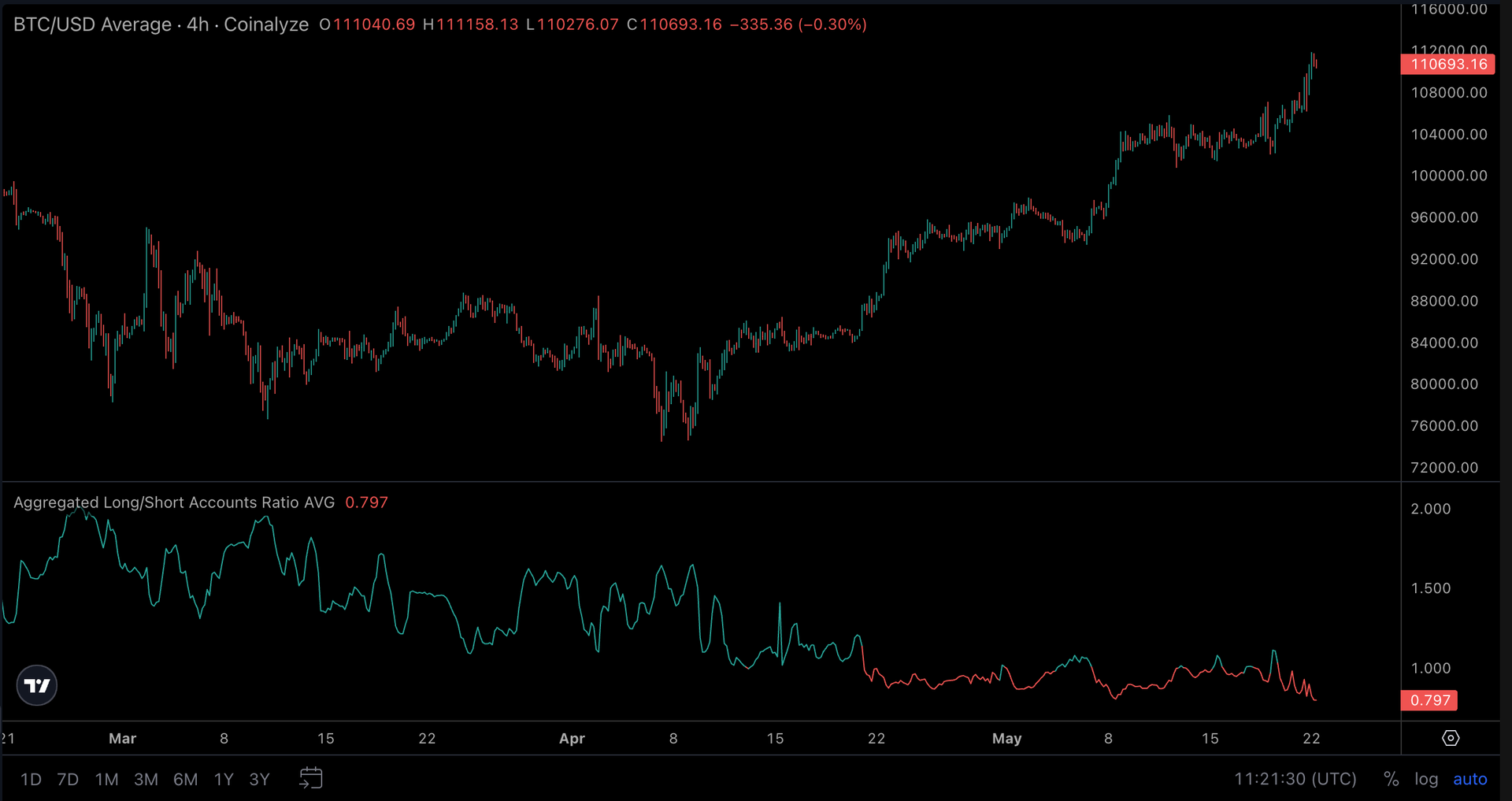

Coinalyze Data He explains that the long/short percentage is at its lowest point since September 2022, which was in the winter encryption.

This trend began on April 21, when traders shortened the penetration over $ 85,000, apparently under the impression that Bitcoin has already formed its cycle high and that any subsequent step will form a double top.

However, though Non -sharing of retailBitcoin continued to grind higher, as she got levels of resistance at $ 97,000 and $ 105,000 on her way.

This step can be attributed to a number of factors; The recovery in stocks in the United States, where tariffs relate to tariffs, high institutional activity, such as CME, and a wealth of short pressure positions and forcing prices on top.

Although these short situations may be considered declining in terms of market structure, they actually hinder the flame to the upward trend because they give the regions of the merchants to target and make them Hunting loss as we saw earlier this week.

The abbreviation of the high asset record is not necessarily a bad strategy; The trader often chooses to enter a short location at the resistance level, whether technical or psychological, and the layers stop the losses above as the short trade thesis will be nullified.

In this case, if the trader shorten 105,000 dollars on each of the three BTCs tests for that region, they may have closed their position on profit on three occasions at $ 102,000, which means that even if it is stopped from trade at $ 109,000, this will be a profitable week.

Besides the constant height of short situations, we saw the open jumping to jump inappropriately to BTC. Over the past 24 hours, BTC has increased by 4.8 % while open interest increased by 17 % despite the liquidation of hundreds of million million.

This indicates that the high lifting comfort is driven by luxury and may be less sustainable than that the initial engines exceed $ 100,000 in December and January.

It remains to see whether interest in short situations continues to rise if BTC continues its important movement over 111,000 dollars, but there is definitely a minefield of short pressure positions if it needs some ammunition.

publish_date