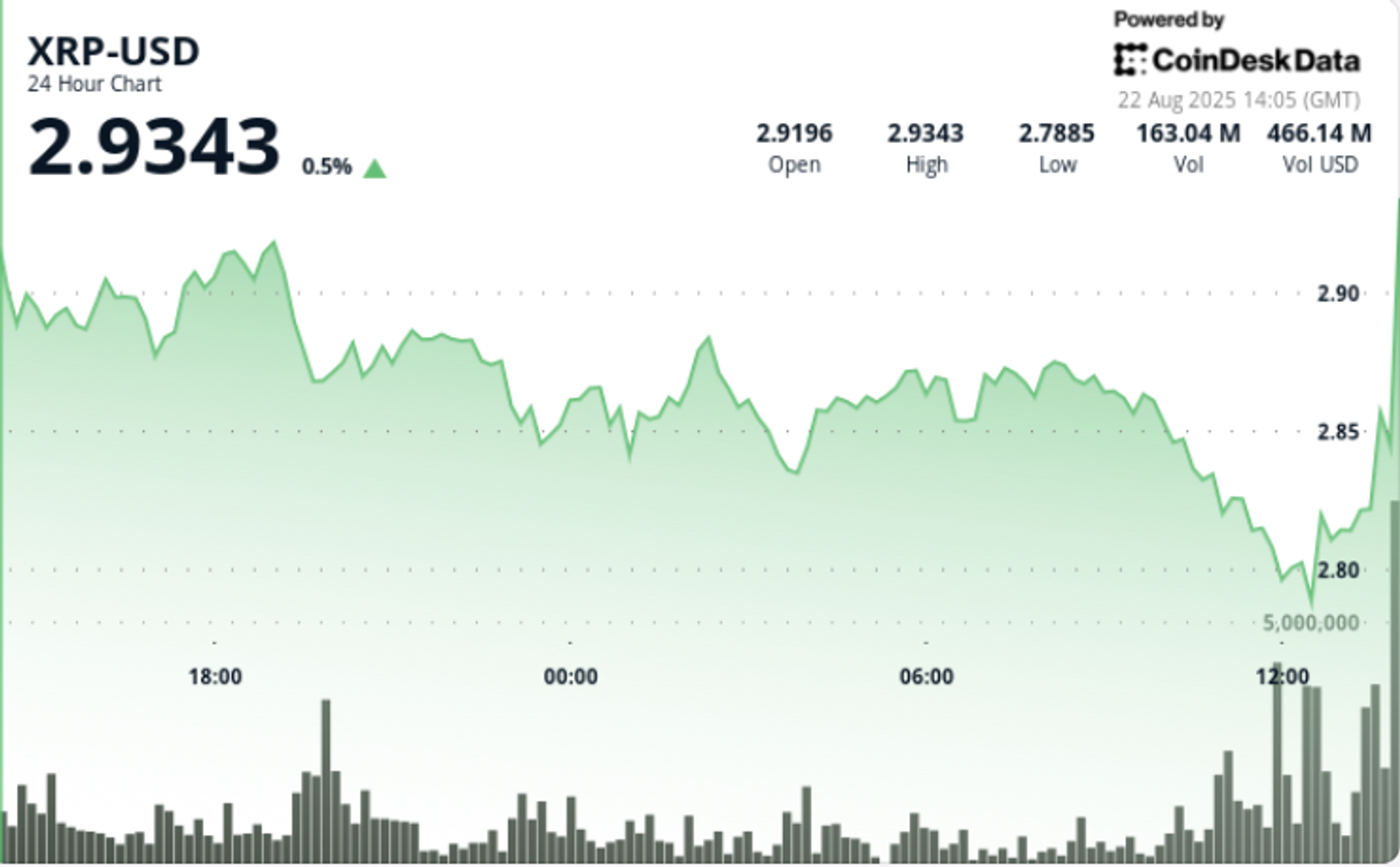

XRP has been 3% as Bitcoin spikes in Powell comments

The XRP spun 3% while Federal Reserve Chair Jerome Powell strictly puts a September rate cut on the table on Friday, causing higher bitcoin (BTC) tokens (BTC) and major tokens.

470 million token sellooffs pushed the volume of spikes and heavy resistance to $ 2.92, while ETF delays and vulnerable ranks of compound bearish pressure security.

News background

• Liquid institution that leads the trade while 470 million XRP has been offloaded to the major exchanges in the August 21–22 window, which has been alerted to a sharp sale.

• On-chain settlement volumes advanced 500% to 844 million tokens on August 18, one of this year’s largest spikes, which signed the growth of adoption despite market weakness.

• The SEC has postponed decisions on XRP ETF applications, including NASDAQ coinshares filing, which is expected today in October. The delay increases the uncertainty in the regulation.

• A security assessment places XRPL in the lowest ranking of 15 blockchains, raising concerns about network stability and increasing bearish sentiment.

Summary of price action

• XRP 3.1% refused the 24 -hour session from August 21 13:00 to August 22:00, falling from $ 2.89 to $ 2.80.

• The token reached $ 0.12, a 4.25% of the band’s volatility, between a $ 2.92 peak and $ 2.80 trough.

• The sharp move occurred at 19:00 on August 21, when the XRP was rejected at $ 2.92 to 69.1m quantities, confirming the main objection.

• Final Trade Time (August 22 11: 24–12: 23) The XRP saw a drop of 2.5% from $ 2.82 to $ 2.80 in surging volume of 7.2m, confirming bearish continuation.

• Support appeared near $ 2.80- $ 2.85, but the interest of accumulation has weakened each retest.

Technical indicators

• The resistance hardened to $ 2.92 to 69.1m decline.

• The support identified in the $ 2.80- $ 2.85 zone, even weakened with repeated tests.

• Volume spiked at 96m at 11:00 August 22, confirming bearish compliance.

• Trade range of $ 0.12 (4.25%) features a concentration of volatility.

• Final sale time of 2.5% with 7.2M volume proven bearish continuity.

What do entrepreneurs watch

• If $ 2.80 can hold as support; A break is risk to speed up to $ 2.75.

• Titles associated with ETF, with October decisions key to the broader institutional flow.

• Whale accumulation patterns-adoption of on-chain, but failing price reflects the foundations.

• $ 2.92- $ 3.00 resistance zone as a breakout trigger for bullish reversal.