XRP price should break the main resistance to $ 3 to unlock new all-time highs

Key Takeaways:

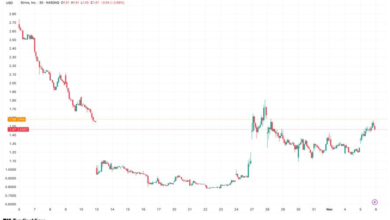

XRP (XRP) The price dropped by 7.6% on Tuesday at an intraday of less than $ 2.80 from a five -month -old over $ 3 on Monday. Analysts said the main level of resistance to $ 3 should be broken to clean the path to new high-time highs.

XRP prices should i -flip $ 3 in support

The 33% XRP rally between July 8 and July 18 was stopped by resistance to $ 3. Bulls should now overcome resistance to $ 3 To avoid a deeper correction.

Historically, the decline from $ 3 has always preceded a significant decline in XRP prices. For example, the last time the XRP/USD pair ran in resistance to $ 3 in March was followed by a 46% drop in price to A Multimonth low of $ 1.61 Reached on April 7.

If XRP breaks $ 3, the next stop can be new all-time highs, Says Crypto analyst Casitrades in a post of Tuesday in X.

According to the analyst, this level is aligned with the Macro 0.118 Fibonacci Retracement from $ 3.40 and “Re -reclaiming it is another massive signal that wave 3 is alive and speedy.”

Related: XRP price ‘high rare’ setup eyes 60% get past $ 3, says veteran businessman

Casitrades said a breakout above $ 3, followed by a quick retest that confirms it as a new support, will see an immediate continuation of $ 3.40 and more.

“When the $ 3.40 (ATH) breaks down, people are likely to be surprised how fast it runs. There is no way after that. Expect it to be unlucky -believing fast and changing -change!”

As cointelegraph reportedThe price of XRP should break $ 3 to clear the path to $ 3.40 and higher.

XRP Liquidation heatmap hints at $ 3.04- $ 3.14

The binance XRP/USDT Liquidation Heatmap The main zones of liquidity zones are revealed where major exacerbation events can occur. These levels often act as magnets, which influence the price direction based on the amount of liquidity at a given level.

A high concentration of fluids can be seen above $ 3.04, with a yellow area indicating a cluster of leveraged positions, suggesting that it is a significant level of resistance.

If the level of $ 3.04 is damaged, it can spark a extermination, forcing short consumers to close positions and driving prices towards $ 3.14, the next major liquidity cluster.

The latest increase in XRP prices is accompanied by an uprising on leveraged positions, with the combined -with Open interest (OI) reached $ 8.11 billion, up to 121% since June 23. It was 3% below the peak of $ 8.33 billion reached on January 19.

Despite the increased risk of fluids in the event of a deeper XRP price correction, derivatives are data points to further reverse the potential.

This article does not contain investment advice or recommendations. Every transfer of investment and trading involves risk, and readers should conduct their own research when deciding.