Blog

XRP Symmetrical Triangle forms under $ 3.00, $ 3.30 Breakout Level in Focus

News background

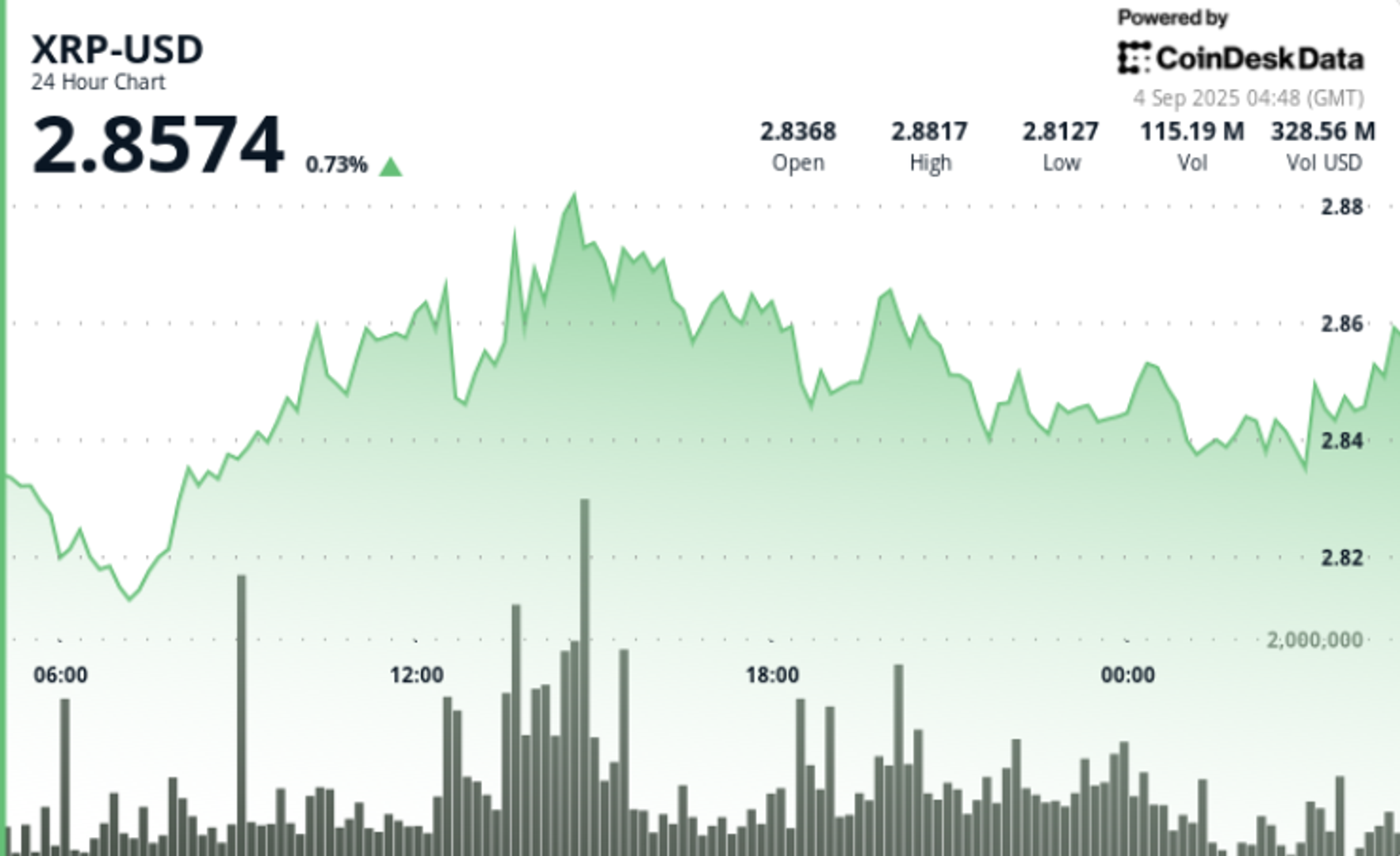

- Exchanged by XRP to a narrow 2% range from $ 2.81 to $ 2.87 During the 24H session from September 2 and 14:00 to Sept. 3 at 13:00.

- Large wallets accumulated almost 340m XRP (~ $ 960m) Over the past two weeks even the institutions have been liquid ~ $ 1.9B since July.

- Total volume of transaction across XRP ledger reached 2.15B XRP on September 1more than double typical day -to -day activity.

- Analysts remain divided: some highlights of long -term bullish structures (symmetrical triangle, as of elliott wave) with upside down $ 7- $ 13While others warned the momentum fading below the multi-year resistance to trendlines.

Price action

- XRP is closely opened $ 2.84 and closed to $ 2.85up slightly despite the volatility of the intraday.

- Price sink early $ 2.84 → $ 2.79then bounce at $ 2.87 By noon on September 3.

- Support developed in $ 2.82Repeatedly attracting bids.

- The resistance is near $ 2.86where the distribution pressure intensifies.

- The final trading time saw an upside down: a spike in $ 2.873 (12:38 GMT) In 5.38m volume was declined, pushing the price back to under $ 2.85.

Technical analysis

- Support: The $ 2.82 zone remains the main area of demand. Below, $ 2.70 and $ 2.50 will follow.

- Resistance: $ 2.86– $ 2.88 continues to act as an overhead supply. The $ 3.00 is the psychological drawback, with $ 3.30 as a breakout confirmation.

- Momentum: The RSI was stable in the mid -50s, showing a neutral bias with a slight bullish lean.

- MACD: The histogram that converts to the bullish crossover, the momentum signing can be strengthened if the volume continues.

- Patterns: Symmetrical triangle integration -Includes under $ 3.00 whole. Breaks above $ 3.30 unlocking higher targets.

- Volume: Session surges (93m – 95m compared to 44m AVG) points to active institutional flows.

What do entrepreneurs watch

- If $ 2.82 support holds under the modified pressure.

- A decisive close to the top $ 2.86– $ 2.88Then $ 3.00 and $ 3.30 for a breakout setup.

- Whales flows: continuous accumulation compared to the ongoing sale of the institutional.

- Regulations and Macro catalysts, including Fed policy and pending SEC clarity, which can quickly change emotion.