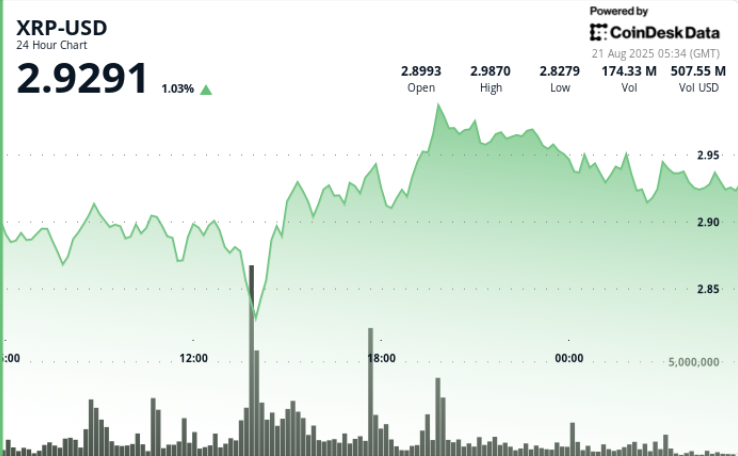

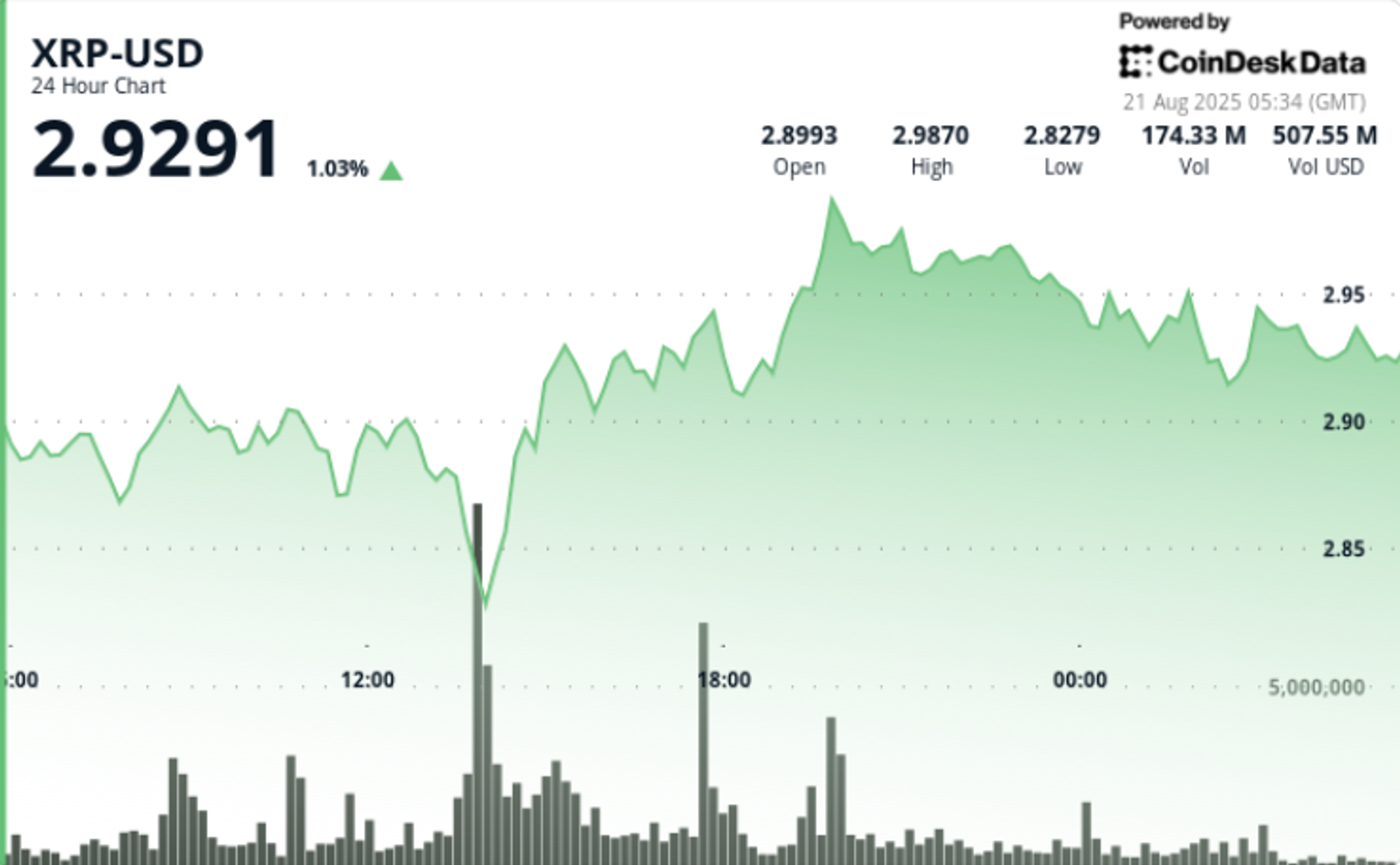

XRP whipsaws to $ 2.84- $ 2.99 range as bulls eye breakout above $ 3

The XRP rallied towards the $ 3 mark in the previous session, with a trading volume spiking more than 6% above its weekly baseline.

News background

• The XRP rally comes in the middle of a broader crypto stabilization, with altcoins that monitor moderate flow after the drawdown last week.

• On-chain data flagged the institutional flows, with about 155 million in the XRP turnover during recovery, which is over 63 million daily average.

• Market Chatter first suggested that the XRP hit new highs, though the actual all-time peak remains $ 3.84 from January 2018-emphasized that this is a recovery test, not discovering the price.

Summary of price action

• XRP sank 5.1% between $ 2.84 and $ 2.99 to 23-hour window from August 20 13:00 to August 21:00.

• The strongest push came around 19:00 UTC on August 20, when the token advanced from $ 2.84 to $ 2.99 to 80.6 million quantities.

• Subsequent sessions showed integration -together, with repeated bounces at $ 2.89- $ 2.93, confirming it as a temporary support.

• A sharp whipsaw in the last hour (August 21 11: 03–12: 02) saw an 8.6% swing: from $ 2.916 to $ 2.901 to 960,000 units, before stabilizing.

Technical analysis

And Support: $ 2.89– $ 2.93 zone shows a lot of strong bounces above-average participation.

And Resistance: $ 2.99– $ 3.00 psychological ceiling caps momentum; Repeat -rejecting is visible.

And Volume: 80.65 million during the rally compared to a 24 -hour baseline of ~ 63 million.

And Pattern: Sideways Integration -Includes Bullish impulse; Momentum tilting slightly down.

What do entrepreneurs watch

• If $ 2.93 support holds in a short time or gives way to a retest of $ 2.82.

• Breaks above $ 3.00 as a potential trigger for the continuation of the trend.

• Maintenance of volume – if the taper flows, the bulls are at risk of losing control.