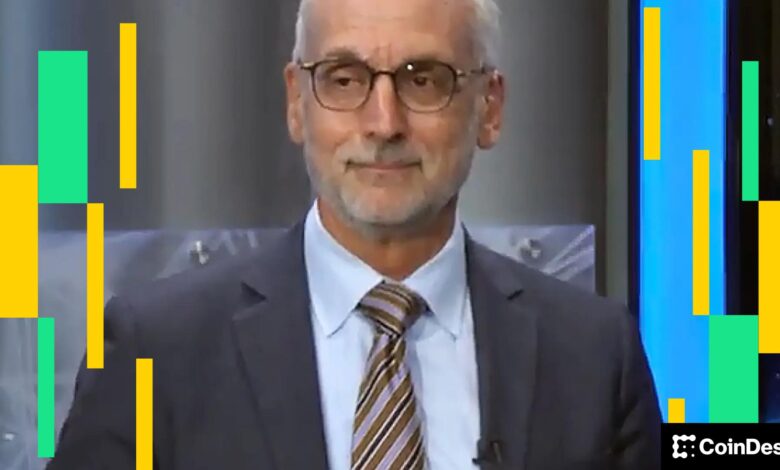

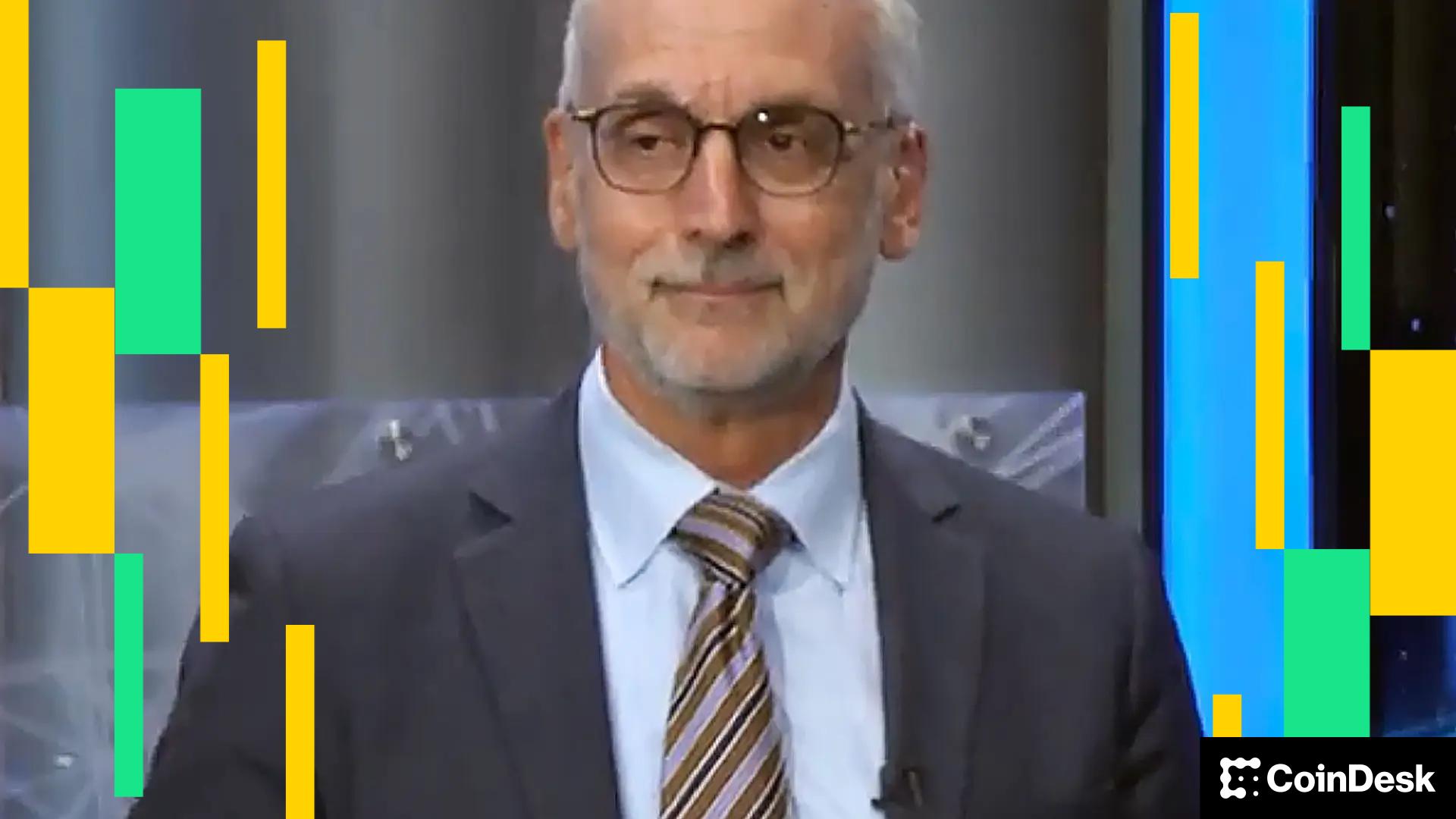

Ripple Chief Legal Officer Stuart Alderoty said Congress should finish Congress

Washington has a narrow window to deliver clear US crypto policies, Ripple Chief Legal Stuart Alderoty’s leader, urging lawmakers to “finish work on crypto clarity.”

Sa an on-ed Published Monday in RealClearketkets, Alderoty said the Securities and Exchange Commission was at the forefront of the first time the Crypto clarity was listed in its leading priorities -signal that “time has come” for unpredictable administration. He confirmed the issue as a mainstream, not a suitable place, pointing to the adoption and voting of the consumer showing extensive support for stronger guards.

Alderoty mentioned some data points to make the case.

A National Cryptocurrency Association (NCA) survey along with the Harris Poll found nearly one in five adults in the US owned crypto. Pew research reported That most Americans do not have the confidence that the current ways to invest, trade or use crypto are reliable and safe. And a yougov Poll showed more Americans favored lighter crypto regulation than looser policies.

He also references to chainalysis Estimates That Americans were blazing over $ 1 trillion in digital assets in 2024, spannings used from payments to savings.

“The lack of clear, consistent policies does not lose the crypto,” Alderoty wrote, warning that it pushed the activity to the constituents that move faster. He argues that clarity will both protect consumers and assure responsible companies to build in the US

Alderoty is also president of National Cryptocurrency Associationa nonprofit education in crypto launched On March 5 with $ 50 million grant from Ripple. The NCA said it aims to boost reading and safe adoption by explaining user and stories, and its polls have found most current users who want to learn more about technology.

In weighing the Congress of the Stablecoin-Structure Congress after the Stablecoin Law of this summer, Alderoty threw the autumn session as an important moment. “The opportunity is in front of us. The mandate already has,” he wrote, adding that lawmakers could “prove to the Americans that Washington could, in fact, deliver clarity where needed.”

He concluded that the end of the rules would maintain a change in the coast and ensure that the US would lead to the shaping of financial infrastructure in the future.