BNB price shows being stable after Israel-Irn Clash Sparks Risk Asset Flight

Binance Coin (BNB) shows being steady after a storm for financial markets, like meSrael attacked Iran In a bid to limit the nuclear program and missile capabilities, leading to a large missile attack in response.

The conflict saw investors flee to risk assets and led to more than $ 700 million in crypto market destruction in just 24 hours, according to Coinglass. The BNB, however, managed to maintain a narrow trading range of more than 1%, which is resistant to a broader pullback of Altcoin.

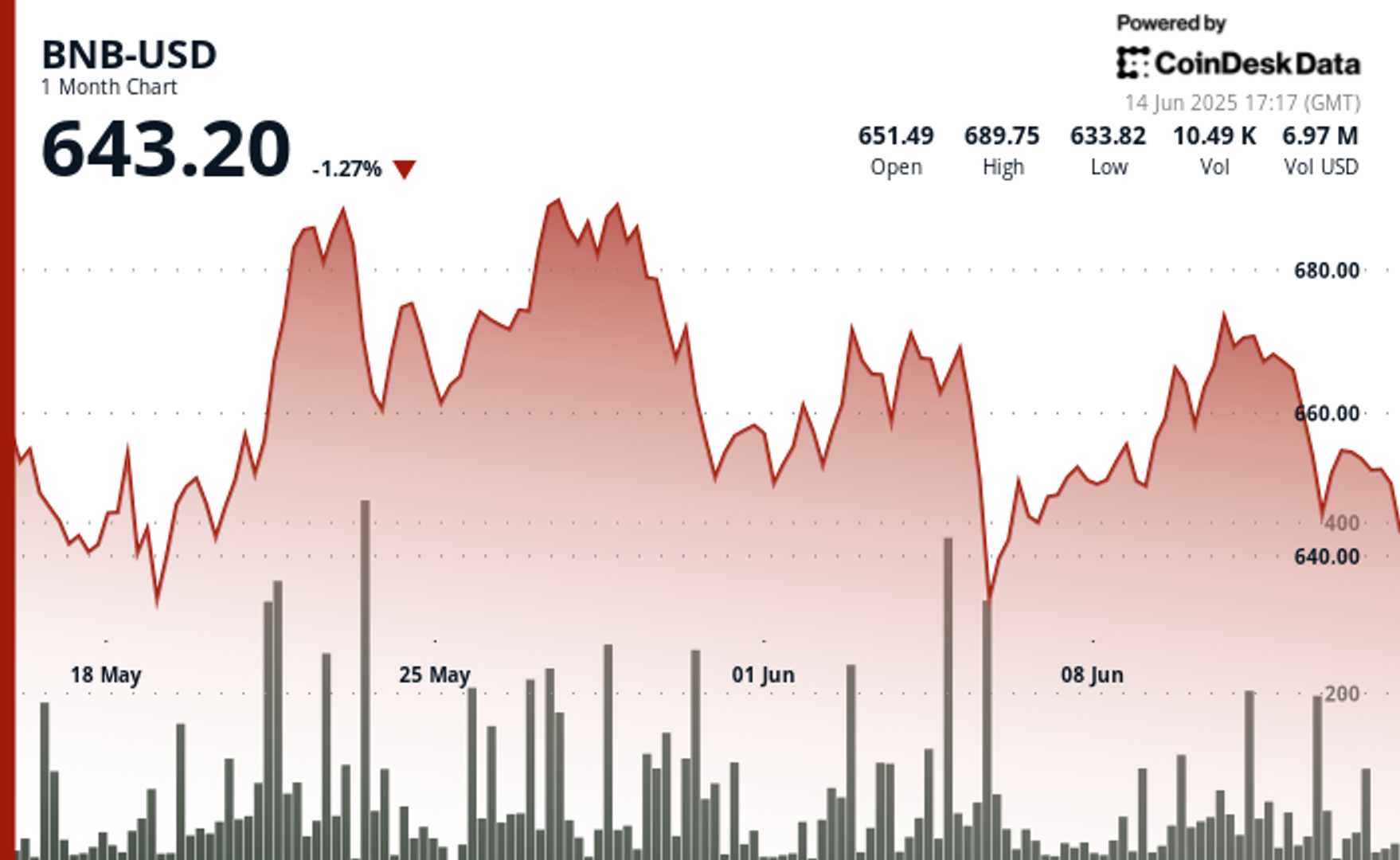

The BNB, after the sell-off, failed to break above $ 660, its immediate level of resistance according to the technical examination model of CoinDesk’s technical examination, and has since been compiled within a pattern of the symmetrical triangle.

Despite the setback, the coin remained above the main support of $ 640, a zone aligned with the 78.6% level of fibonacci retracement. The trading volume assessment suggests sellers dominate near $ 655.5, while a base buyer forms around $ 649, the model shows.

Technical signals are a mixed picture. The moving average change of the MacD (MACD) became negative, and the Kamag -child Index index (RSI) sat only under 50, indicating the fading momentum.

However the 50/200-day transfer of averages approaches a gold cross, and the Chaikin currency flow indicator remains positive, a history setup that has previously been upward, according to the model.

But the emotion around BNB is not all bullish. The volume of the net taker, a scale of aggressive sales pressure, struck a multi -week -$ 197 million.

Meanwhile, although the ongoing amount of Binance Smart Chain trading has increased monthly, this activity does not appear to have led to new demand for BNB. Open the interest of futures remains more than 30% from the peak of December.