Why Blockchain Games Betray Digital Property Rights

Every year, my company Emfarsis partners with the Blockchain Game Alliance (BGA) to conduct an industry-wide survey of blockchain gaming professionals. And every year, overwhelming numbers of respondents agree that digital asset ownership is the single biggest benefit blockchain can bring to games; this year is no different, with 71.1% ranked it number one. Even more people joined the industry — in 2024 we had three times as many respondents compared to the inaugural survey in 2021 — it is always digital asset ownership is emerging as the industry’s undisputed North Star.

But while we drew on digital asset ownership as the defining feature of blockchain gaming, most blockchain games today are free-to-play and do not require asset ownership. Beyond that, the cherished promises that rest on the premise of digital asset ownership remain unfulfilled. Apparently, blockchain gaming professionals have found themselves in a strange relationship where the best proposition they have for players is the same thing they stand for.

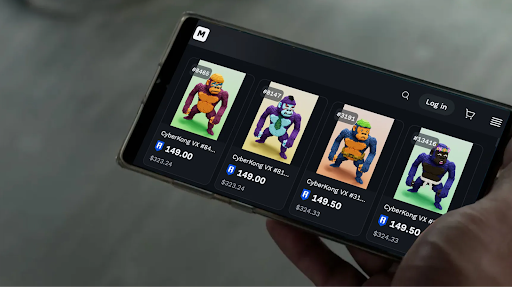

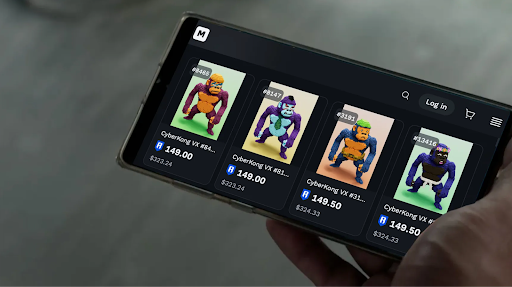

Digital asset ownership has always been central to blockchain gaming, offering players true digital property rights to own, trade, and monetize in-game assets in the form of tokens and NFTs. Coming back to play-to-earn’s heyday of 2020-21digital asset ownership is how you tell the difference between a blockchain game and a traditional game. Early games required players to purchase one or more NFTs in advance. But this created a barrier to onboarding, as many couldn’t afford the NFT(s) or simply weren’t excited about having to buy an asset in a game they didn’t even know they wanted.

Of course, these NFTs aren’t just any old game assets, they yield a yield. Buying NFT in a blockchain game is more like investing in a tool that you need to do a job — a job paid for in crypto. Some of the more business-minded NFT owners have started renting their assets to would-be players, in exchange for a cut of their profits. It’s an amazing demonstration of the kind of decentralized, permissionless innovation made possible by blockchain — a community-led solution built by gamers, not game developers.

Amazingly, the rental system popular in early blockchain games like Axie Infinity, Pegaxy, CyBall, and others, didn’t really solve the onboarding problem. The limited availability of assets and high entry costs create a bottleneck, so rental demand cannot be met, so the friction with top-of-the-funnel user acquisition continues.

By 2022, in an effort to lower barriers and attract a wider audience, blockchain games began to embrace the free-to-play model instead. With this, the blockchain-based features of the game are treated as optional enhancements rather than a prerequisite to play. Players can buy assets later, or put in the time and effort to earn them, but only if they want to. There is no explicit requirement to do this.

The move comes at a time when blockchain games are being forced to focus less on financialization and more on fun. And it was seen as necessary if they wanted to get a part of the big, juicy $220B traditional gaming marketconsisting of billions of players who are unlikely to install a crypto wallet and save money for an NFT.

This contradiction – where digital asset ownership is both a defining feature and a significant obstacle – reflects the complexities of blockchain gaming’s evolution. On the one hand, ownership is what makes blockchain games special; on the other hand, requiring it hinders players. To attract traditional players, who have no familiarity with Web3, the developers prioritized accessibility.

Findings from 2024 BGA State of the Industry Report back it up. When asked about the biggest challenges facing the industry, more than half (53.9%) cited onboarding challenges and poor user experience, while another 33.6% said that blockchain concepts are not fully understood. So, without clear, tangible benefits, the effort and expense of becoming a digital asset owner is not justified. This presents a major pain point for developers who try to sell noobs on a clunky tech stack as more of a chore than an option, so you can see how they came to the decision not to force it.

But this raises the question: How much blockchain can a blockchain game remove, before the blockchain game is no longer a blockchain game?

This half-hearted approach to embracing on-chain experiences means that potentially transformative native Web3 innovations — such as the promise of interoperability, where players can use swords from Game A to Game B — remains largely theoretical. Some progress has been made, such as enabling NFT profile picture (PFP) collections to become playable avatars, but this mostly caters to existing web3 communities rather than delivering tangible benefits to appeal to the Web2 gaming masses.

True interoperability requires collaboration across industries, both technical and economic, which are still fragmented across chains and ecosystems. Meanwhile, developers are sweeping Web3 under the rug, treating it as a layer in the tech stack rather than a defining feature. So for most players, the “Web3” part is hidden, optional, and about as impactful as a collected spoon in a cereal box.

Frankly, the notion of “owning” Web3 is wildly overhyped and largely unsupported by any substantial product-market fit. Owning Web3, as it is often sold, is a mirage. The truth is: even if you “own” an NFT, its utility and value often depend entirely on the developers’ centralized infrastructure and ongoing operations. What Web3 offers is increased agency over your assets, allowing for faster and frictionless sales. But the real ownership? Not so much.

There is actually little evidence to suggest that Web3 ownership has driven sustainable demand. That said, the ability to exercise more control over your digital assets is undeniably important — just not the “real ownership” that’s often claimed.

That said, there are some very promising experiments in fully onchain games and creative catalysts such as the Loot NFT collection. Its composable structure allowed developers to build derivative projects, games, and economies around it without requiring approval or input from the original creators.

Other recent innovations born in the arena of digital asset ownership include the Ethereum standards ERC-6551, ERC-4337, ERC-404 and soulbound tokens (SBTs). ERC-6551 introduced tokenbound accounts, which allow NFTs to act as their own wallets. ERC-4337 delivers account abstraction, enabling customizable wallets that improve security and usability without relying on centralized custodians. ERC-404 combines the features of fungible and non-fungible tokens, to offer flexible ownership of both unique and divisible digital assets. SBTs provide us with immovable, identity-related assets that represent credentials for trust and reputation.

While still early on the adoption curve, these advancements empower gamers to unlock experiences that would not be possible without digital property rights. And the results of BGA’s annual survey confirm that the appeal of digital asset ownership remains strong: it gives players agency, control and value.

The challenge now is to let players experience the fun first hand and discover the value of ownership organically. But we shouldn’t be ashamed to stand up for what we truly believe. If we want others to get our point of view, we need to build experiences that demonstrate the benefits of digital asset ownership from the ground up.

Otherwise, we’re not doing anything very special. are we

Thanks to Nathan Smale, Duncan Matthes and Owl of Moistness for their review of this article.

The author holds many cryptocurrencies, including Web3 gaming-related tokens such as YGG, RON and SAND, and is an angel investor in 15+ Web3 startups.